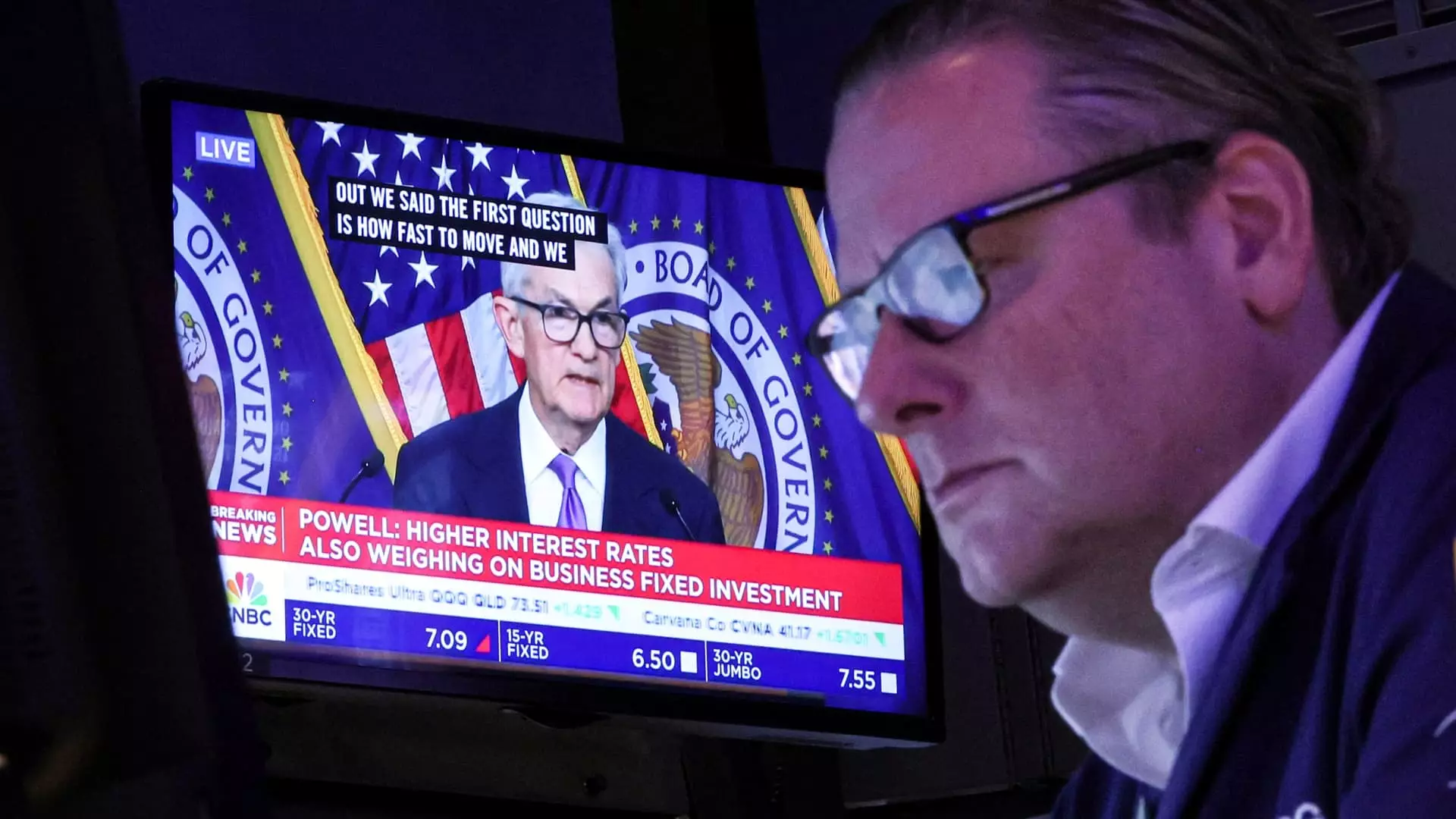

As we approach the end of the year, the Federal Reserve is under pressure to adjust interest rates. A quarter-point reduction is anticipated at the conclusion of its upcoming two-day meeting on December 18, marking the third consecutive cut since September. Collectively, these adjustments have reduced the federal funds rate by a full percentage point, following an aggressive rate-hiking phase aimed at curbing inflation, which recently struck a 40-year peak. However, the overall economic landscape is far from stable, as uncertainty looms surrounding fiscal policies proposed by the newly elected president.

Jacob Channel, a senior economic analyst at LendingTree, notes that this could very well be the final rate cut for the foreseeable future. The Fed appears inclined to adopt a cautious “wait-and-see” approach, particularly in light of the unpredictable implications of incoming fiscal policies. This strategic pause could yield varied impacts on consumer borrowing, as interest rates profoundly influence various types of loans.

The federal funds rate, which the Fed controls, serves as a critical benchmark for various borrowing costs across the economy. Although individual consumers do not directly engage with this rate, its fluctuations reverberate throughout financial markets, ultimately influencing the terms they encounter in their daily lives. Should a further rate cut materialize in December, the overnight borrowing rate would decrease to a range of 4.25% to 4.50%. While this adjustment might alleviate some financial pressure, experts emphasize that the effect will not be universal.

Brett House, an economics professor at Columbia Business School, argues that many essential interest rates consumers encounter are not directly linked to the federal rate. For instance, credit card companies and lenders might take their time in reflecting these adjustments in their rates, leading to a delay in any benefits for consumers.

The interconnectedness of interest rates means that shifts in the Federal Reserve’s policy can influence multiple facets of consumer borrowing—from credit cards to mortgages. Variable-rate credit cards are one of the most sensitive to the Fed’s changes, with their typical rates historically moving in tandem with the federal funds rate. However, despite recent cuts by the central bank, credit card interest rates remain stubbornly high, hovering around 20.25%, well above the rate of just 16.34% a year earlier.

Bankrate’s chief financial analyst, Greg McBride, points out that issuers often delay lowering their rates after cuts, which can exacerbate the debt burden for consumers already grappling with high interest. In many cases, consumers are better served by seeking out a 0% balance transfer credit card and actively paying down their existing debts, rather than waiting for rate reductions that may not come fast enough.

Meanwhile, the mortgage market presents its own set of challenges. Fixed-rate mortgages tend to remain stable and are primarily influenced by broader economic indicators—such as Treasury yields—rather than directly by the Fed’s policies. Current rates for a 30-year fixed mortgage are at approximately 6.67%, down slightly from a previous month, but still significantly higher than earlier this year.

Experts like Channel suggest that mortgage rates may continue to fluctuate week by week, making it difficult to predict future trends. Homeowners with existing mortgages generally find that their rates remain unchanged unless they opt to refinance, which involves additional costs and financial implications.

Auto loans are also feeling the pressure of rising costs alongside interest rates. Currently, the average five-year car loan rate stands at about 7.59%. While a reduction in interest rates might eventually provide some relief for car buyers, the substantial price tags associated with vehicles mean that even lower rates may not alleviate the financial strain caused by high monthly payments.

Student loans present a complex scenario. While federal loans typically have fixed rates unaffected by market fluctuations, private loans might see immediate adjustments with any cuts in the federal funds rate. The opportunity for refinancing into more affordable options presents potential savings for borrowers, but it comes with significant caveats, particularly for those considering shifting federal loans to private lenders.

The Federal Reserve’s decision-making will undoubtedly influence the economic landscape in the upcoming months. While anticipated interest rate cuts may ostensibly ease borrowing costs, the real-world implications for consumers could be muted. Individuals will need to remain proactive in managing their debts and financial commitments, as the benefits of any rate reductions may not materialize as quickly or broadly as hoped. In the end, consumers must navigate a complex maze of economic variables to make informed decisions that align with their financial goals.