The financial landscape in recent weeks has displayed a polarity between bearish trends and optimistic recoveries, notably illustrated by the response to the Federal Reserve’s recent interest rate cut. Chair Jerome Powell’s decision to implement a quarter-point deduction in rates was framed with a hawkish tone, evoking immediate adverse reactions in the stock market. However, the remarkable turnaround observed on Friday, where the Dow Jones Industrial Average rebounded nearly 500 points, signifies that market sentiment can shift rapidly, highlighting the importance of real-time analysis in investment strategies.

The Aftermath of Interest Rate Decisions

When the Federal Reserve announces changes to interest rates, the ramifications can ripple throughout various sectors. Investors often find themselves in a state of trepidation, absorbing the nuances of the Fed’s commentary as they attempt to gauge future market conditions. Powell’s recent remarks, signaling potential concerns about inflation and economic stability, showcased a cautious Federal Reserve, creating uncertainty in equity markets. Stocks, particularly in tech, often see heightened volatility in these periods.

The rebound on Friday, however, demonstrated resilience among investors who are strategically poised to seize opportunities. The notion of a “Santa rally”—seasonal upticks that often occur towards the end of the year—seems more plausible following such recoveries, particularly within certain sectors like semiconductors, which are crucial in the tech landscape.

Focusing on Semiconductor Stocks: A Market Analysis

Among the tech titans, Nvidia stands as a formidable influence, substantially driving interest in semiconductor stocks. As a pioneer in graphics processing units, Nvidia’s performance can serve as a barometer for the semiconductor sector. Recent trends indicate renewed buying interest in Nvidia, setting the stage for broader gains across the semiconductor market.

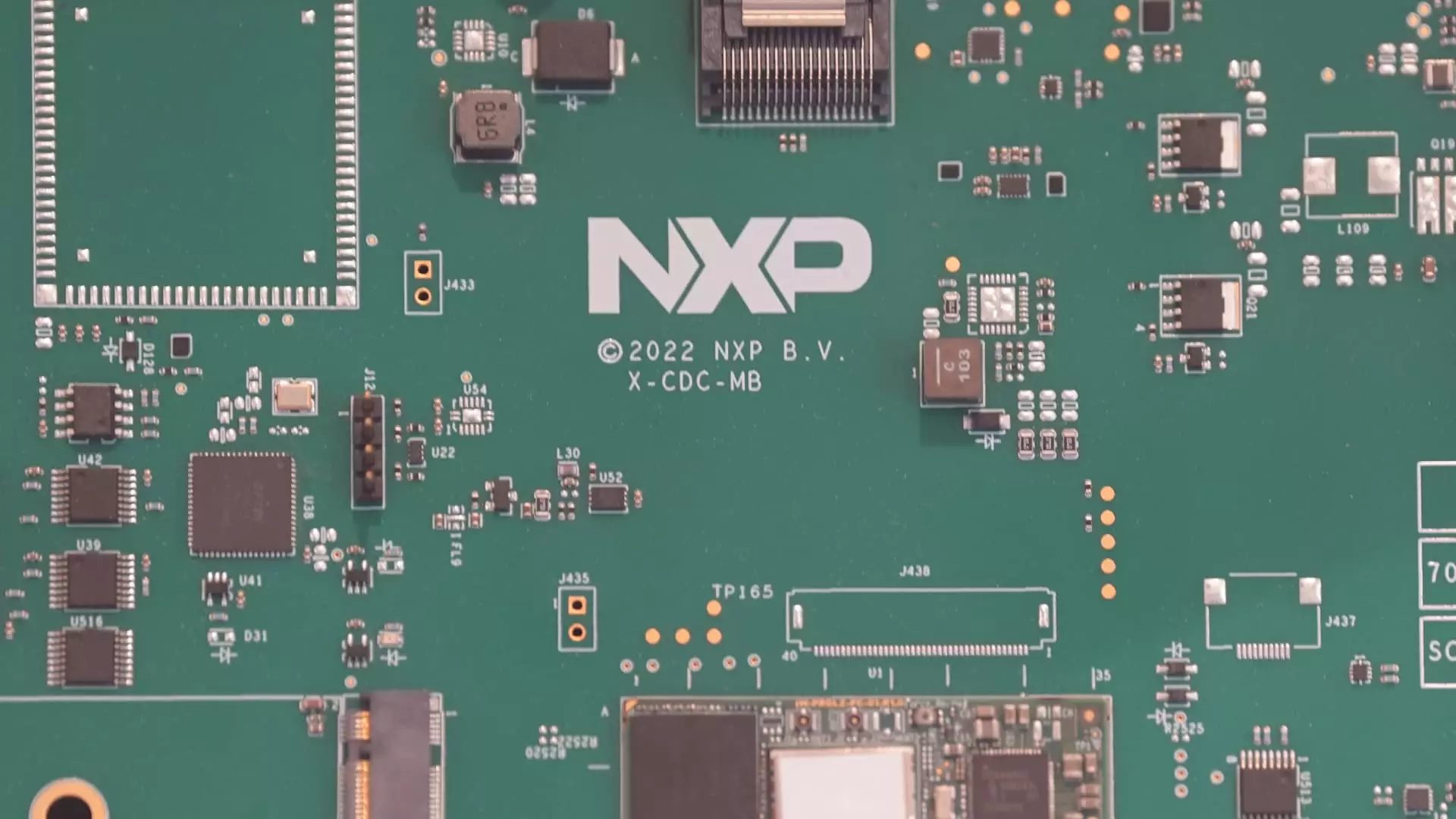

A key player gaining traction during this period is NXP Semiconductors NV (NXPI). This stock’s trajectory is being closely watched, especially in light of its technical indicators suggesting a potential bullish reversal. Technical analysis provides a quantifiable approach to understanding market dynamics; thus, examining metrics such as the Relative Strength Index (RSI) and the Directional Movement Index (DMI) can furnish traders with invaluable insights.

As the RSI indicates an uptrend shift, it contributes to a bullish sentiment surrounding NXPI. A higher RSI suggests buying momentum, while a rising DMI can denote the end of a prevailing downtrend. These technical metrics, coupled with price action patterns that signal recovery—like the emergence of green candles indicating upward movement—imply that NXPI may indeed be poised for a substantial upswing, making it an exciting prospect for investors.

The critical element in trading NXPI is to formulate a risk-mitigated trading strategy. A bull call spread can be an effective avenue here, minimizing exposure while capitalizing on bullish trends. By purchasing a $210 call while simultaneously selling a $215 call, investors can define their risk and potential reward more explicitly. This setup offers a clear vantage point to engage with upward price movement while ensuring that any capital at risk is controlled.

Strategic Trading for Maximum Profit

Implementing a strategy such as the bull call spread enables traders to maximize potential gains without inviting excessive risk. Taking the example where an investment of $2,500 could yield a corresponding $2,500 profit if NXPI surpasses the $215 mark by the expiration date points to a dynamic opportunity for those interested in the semiconductor arena.

Investing in the volatility of tech stocks, particularly with major players like NXP Semiconductors, represents an intricate dance of risk and reward. Bolstered by the recovery observed in the broader market, now may be an opportune time to explore positions in this sector amid the ongoing narrative driven by Federal Reserve policies and market sentiment.

While navigating the complexities of the stock market requires vigilance and adaptability, the recent fluctuations offer numerous investment opportunities, particularly in the semiconductor sector. Coupling thorough technical analysis with a defined strategic approach not only aids in capitalizing on current trends but builds a framework for informed trading decisions amidst market volatility. As always, prospective investors should consider consulting financial advisors to assess their unique circumstances before embarking on trading endeavors.