The municipal bond market is currently witnessing a complex interplay of factors as 2023 draws to a close. Recent trends indicate a generally subdued environment amid fluctuating U.S. Treasury yields and a constrained new-issue market, which together have left many investors cautiously optimistic but wary of volatility.

As the year comes to an end, the municipal bond sector has found itself somewhat insulated from the downward pressure being exerted by U.S. Treasuries. This is evident as many municipal bonds have displayed a resilience amid changes in Treasury yields. On Friday, for instance, the yield on the 10-year U.S. Treasury hovered above 4.6%, contributing to a loss of up to six basis points in the broader Treasury market. In stark contrast, Triple-A municipal yield curves remained mostly unchanged, indicating that investors are maintaining a certain confidence in the stability of this asset class despite the tumultuous backdrop.

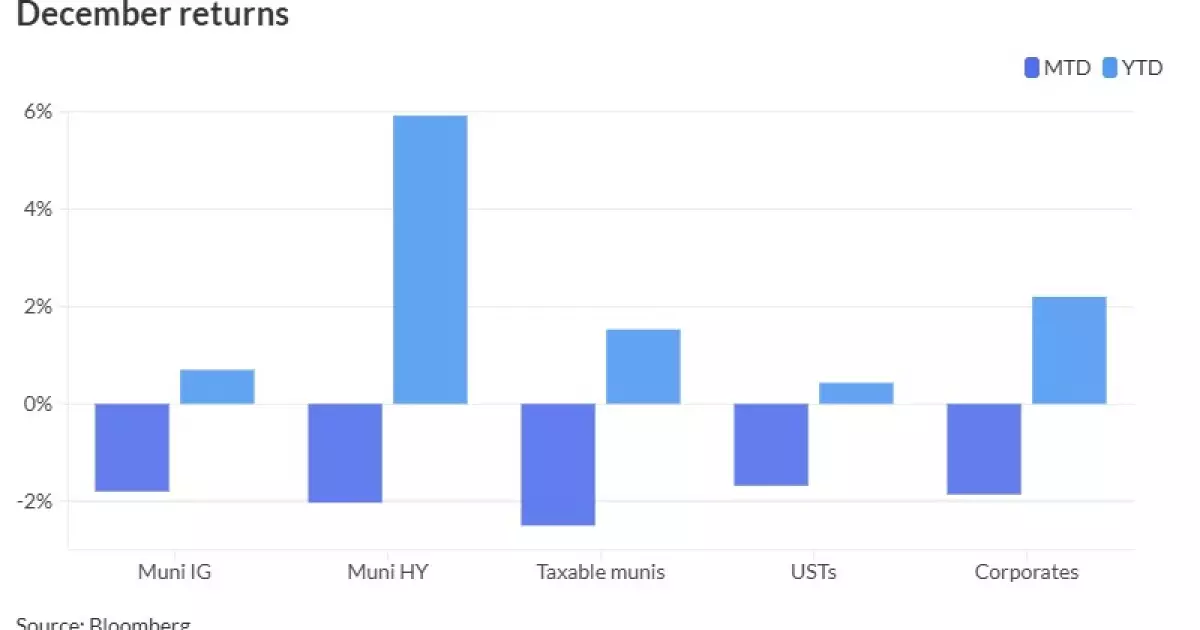

However, the lack of fresh new-issue supply during this otherwise active season has raised concerns about liquidity and demand for municipal bonds. Traditionally, as we approach the end of the year, the market experiences a natural uptick in supply and new issues. Unfortunately, December appears to be an exception, resulting in relatively lackluster performance for the Bloomberg Municipal Index, which is down 1.80% for the month. This stagnation in new supply, compounded by high-yield munis seeing a 2.03% decrease, highlights a reluctance among issuers to flood the market, especially when uncertainty prevails.

The current market scenario has drawn attention to the fundamental elements that underlie municipal bond performance. It is crucial to note that much of the coming weeks will revolve around the balance of supply and demand – particularly amidst predictions of an upcoming Federal Open Market Committee meeting. Senior fixed income portfolio manager Kim Olsan has indicated that there exists an approximately $8 billion gap between anticipated supply and the redemptions expected in the next month, thereby alluding to a tightening of conditions that could increase upward pressure on yields should demand wane.

The supervisory outlook remains cautious. January often heralds an influx of bonds entering the market, typically due to tax planning purposes, but market participants are on high alert given the potential for substantial economic changes, including various tax reforms. Observations suggest that heightened supply paired with Treasury rate fluctuations could lead to increased anxiety among investors, causing capital to flow away from municipal bonds.

The credit landscape for municipal bonds is continually evolving, and nuanced differences in quality between ratings are having a notable effect on market sentiment. The ongoing trend shows that lower-rated bonds have outperformed their higher-rated counterparts in terms of yield and returns throughout the year. The distinction between A-rated general obligation and revenue bonds reveals an ongoing compression of yield spreads, emphasizing investor preference for securities that deliver greater value amid less appealing macroeconomic indicators.

Analysis indicates that while yields on lower-rated bonds have benefitted from tightening spreads, the absolute yield levels across the board are now hovering around 4.00% or more. This resurgence in yields is expected to contribute to better performance for A-rated credits going into 2024. In light of these trends, it’s imperative for investors to reassess their portfolios and consider the implications of credit ratings, especially when determining future allocation strategies.

As we reflect on the dynamics at play in the municipal bond market, it is clear that January could shape up to be a pivotal month. Both the anticipated influx of planned issuances and the external economic factors, including tax reforms and Treasury rate movements, will be heavily scrutinized by market players. The potential for a heavy issuance month could signify either a recovery phase or a point of concern based on how these developments unfold.

While the sentiment around municipal bonds has generally been positive due to a more stable yield environment compared to the past two years, the recent struggles indicate that challenges remain. Investors must keep a keen eye on upcoming trends in both credit performance and market liquidity as we move into the new year. The ability to adapt to these changes will be critical in navigating the complex landscape ahead, ensuring that portfolios are not only resilient but can also capitalize on the shifting tides of the market.