In the evolving landscape of the municipal bond market, recent trends reveal a complex interplay among municipal yields, U.S. Treasury rates, and local economic factors. As the fourth straight session of slight weakening hits the municipal bond sector, analysts are scrutinizing the underlying mechanisms that drive these fluctuations and the implications they hold for investors and issuers alike.

Current Market Dynamics

Recent developments indicate that municipal bonds have experienced losses for four consecutive sessions, coinciding with rising yields in U.S. Treasuries. Specifically, municipal yields appear to have decreased by as much as three basis points, contrasting the upward trend in Treasury yields, which rose by four to five basis points, signaling a potential shift in the investment climate. As a direct result, the two-year U.S. Treasury yield has surpassed the psychological threshold of 4%, a level not seen since late August. This tightening relationship between municipal decreases in yield and Treasury increases suggests a possible recalibration of risk perceptions among investors, seeking refuge in relative safety.

The ratios of municipal bonds to Treasuries are worth noting: the two-year ratio currently stands at 61%, while the 30-year ratio is at 84%. Such figures highlight the competitive landscape for fixed-income options. High ratios could imply that municipal bonds are comparatively undervalued relative to Treasuries, but this dynamic shifts with changing market conditions, warranting close examination by potential investors.

Continued Inflows: A Positive Indicator

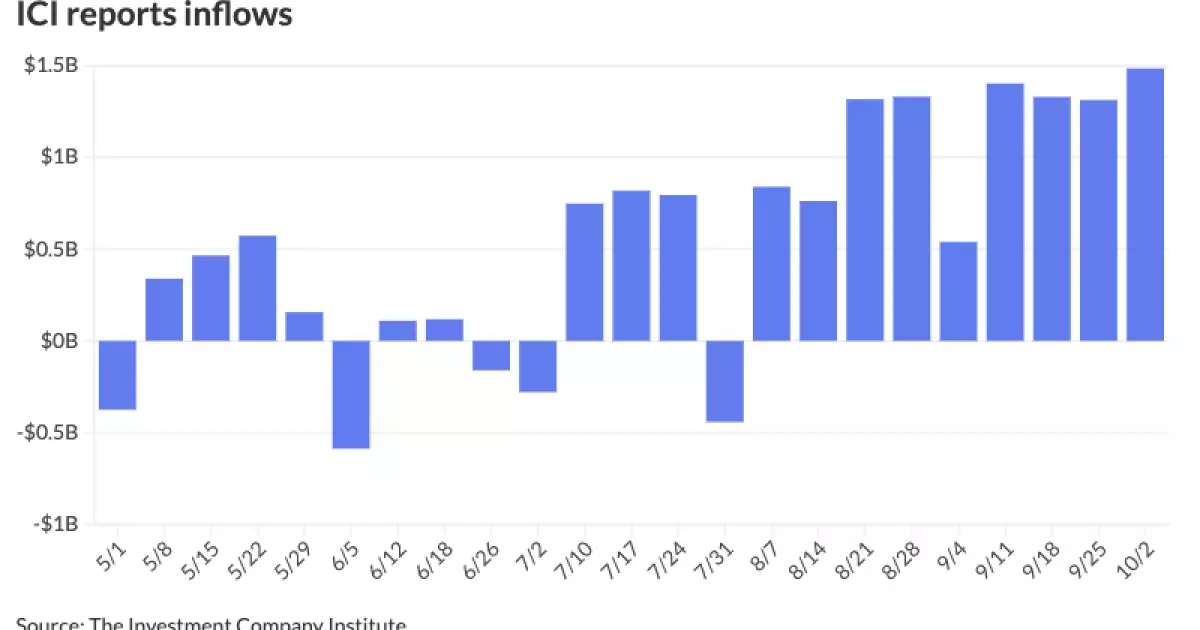

Despite the prevailing trends of weakening municipal yields, the inflow of funds into municipal bond mutual funds continues to rise impressively. The Investment Company Institute reported inflows nearing $1.5 billion for the week ending October 2, building on a streak marked by consistent weekly inflows exceeding $1 billion. Such robust demand underscores a compelling appetite for tax-exempt bonds, reinforcing a generally positive sentiment among investors. This sustained influx can signify confidence in the municipal sector’s long-term viability, despite short-term yield losses.

Furthermore, exchange-traded funds (ETFs) within the municipal space also reflected significant inflows of $810 million, up from a modest $109 million the prior week. Such data indicate an increasing investor preference for the liquidity and flexibility offered by ETFs amidst changing market conditions.

As the market transitions into the fourth quarter of the year, seasoned analysts like Jeff Lipton have pointed to the “directional footing” of munis as an important factor for the upcoming period. With issuers actively front-loading their deals ahead of the imminent presidential election, there exists increased tax-exempt supply. This proactive approach by municipalities facilitates their access to capital while navigating potential economic uncertainties.

The current issuance rate has risen to a new norm where weekly supply regularly exceeds $10 billion, barring breaks for holidays or Federal Open Market Committee meetings. Such a pace may be sufficient to satisfy investor demand; however, with increasing valuations for relative value opportunities in the market, investors may adopt a discerning approach when selecting investments going forward.

In light of recent monetary policy adjustments and the overarching economic landscape, debt markets have sold off in a discernible pattern. Lipton suggests that specific economic data seem to support the Federal Reserve’s continued cautious approach to rate adjustments. A measured pathway to rate cuts poses an intriguing consideration for risk-tolerant investors looking to position their portfolios favorably amid such changes.

As Q4 progresses, the market may likely see more buying opportunities appear as ratios become more attractive. The dynamic nature of institutional investment strategies, contrasting with the influence of retail buyers drawn in by taxable equivalent yield calculations, may serve as a dual engine for continued investment activity in munis.

Upcoming Issuances and Investor Sentiment

Turning to the primary market, significant issuances lined up for the coming days are likely to further define market sentiment. For instance, Connecticut’s general obligation bonds priced at nearly $935 million and the New York State Housing Finance Agency’s $259.64 million in revenue bonds signal a vibrant issuance calendar that could attract keen interest from diverse investor classes.

As state-specific issues come online, opportunities for investors to engage with various municipal bond offerings will continue to proliferate, accentuated by the evolving economic backdrop. The willingness of municipalities to explore financing avenues amid changing conditions may bolster positive investor sentiment in the long run.

In sum, the complexities of the municipal bond market are palpable in current yield movements, inflows, and strategic issuer behaviors. Investors are encouraged to remain vigilant and informed as they navigate these waters—an endeavor expected to pay dividends in an increasingly nuanced financial landscape.