As the U.S. economy grapples with a mix of uncertainties, the municipal bond market finds itself at a crossroads. On one hand, geopolitical tensions and fluctuating macroeconomic indicators are placing downward pressure on U.S. Treasuries; on the other, municipal bonds are displaying resilient characteristics that sustain investor interest. With the backdrop of anticipation for the forthcoming employment data, recent weeks have revealed significant trends in municipal bond inflows and pricing structures.

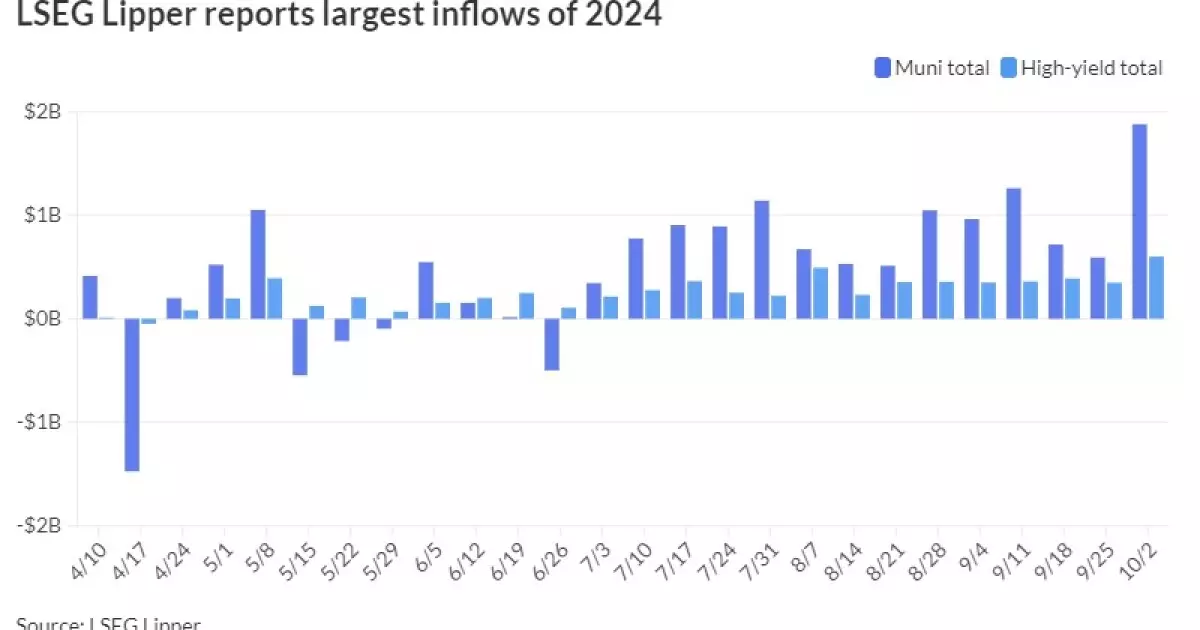

The bond market is often viewed as a barometer for economic health, and in the current climate, it is especially sensitive to external influences. Observations from financial data banks highlight that municipal bonds have exhibited some signs of weakness but remain buoyed by strong investor demand, particularly as bond mutual funds recorded inflows nearing $1.9 billion during the last week alone. This marks an impressive streak of 14 consecutive weeks of inflows, showcasing that municipal bonds continue to be a favored asset class for investors seeking stability and yield.

According to LSEG data, the substantial inflow reported, significantly higher than the $592.1 million recorded the previous week, catapults the four-week moving average to $1.119 billion—a clear indicator of an advantageous trend for the market. Particularly noteworthy is the performance of high-yield funds, which also experienced an inflow surge to $602.3 million from $349.3 million the week prior. This indicates that investors are not deterred by potential risks; rather, they seem to be actively pursuing yields amid broader market volatility.

J.P. Morgan strategists have further dissected this trend, noting that most of the recent inflows are clustering in long-term funds. Estimates suggest that total reinvestment capital is heavily weighted toward the early half of October, hinting at a possible surge in capital deployment in the near term. Another telling statistic is that while municipal issuance rose substantially by 35.2% as of September’s end, demand persists at elevated levels, leading to oversubscriptions and a shift to lower yields in new primary market offerings.

A critical component in understanding the municipal bond performance amidst these turbulent times is the examination of yield ratios relative to U.S. Treasuries. Recent data indicated a downward adjustment in the municipal-to-Treasury ratios across various maturities. For instance, the two-year ratio stood at 61%, while the 30-year ratio was at an elevated 83%. These adjustments reflect both a recalibration of expectations amidst a backdrop of rising Treasury yields and a market effectively absorbing supply.

As reported by multiple financial data providers, including Refinitiv and ICE Data Services, there have been small yet meaningful shifts in AAA-rated municipal scales—indicating slight cuts in yields at different points along the curve. These nuanced changes suggest that while the overall direction of the market may face downward pressures, the robustness of investor demand helps stabilize performance.

In practical terms, this dynamic is evident in recent corporate issuances. In one instance, J.P. Morgan Securities LLC arranged for $265 million in junior lien revenue bonds for San Antonio, Texas, showcasing competitive pricing across various maturities. Similarly, competitive sales, such as the $114 million general obligation bonds from Alexandria, Virginia, highlight investor appetite despite rising rates. This is critical as it signifies that municipal issuers can still maintain favorable financing terms and execute successful offerings.

With market sentiment shifting toward the upcoming employment report, experts are closely monitoring labor data as a potential harbinger of economic direction. Interestingly, the recent ADP employment report showcased a significant uptick in private payrolls, which some analysts interpret as a cue for upside risks in non-farm payroll, potentially influencing market perceptions.

As municipal bonds navigate the complexities of external economic trends, the Federal Reserve’s actions will undoubtedly play a crucial role. Sentiments surrounding front-loading easing adjustments could alter the trajectory of both municipal and Treasury yields in upcoming trading sessions. For now, the municipal bond market exhibits strong undercurrents of stability amid uncertainty, reflecting growing investor confidence.

While the municipal bond market faces persistent challenges from geopolitical uncertainties and fluctuating economic indicators, it remains resolute. Not only do inflows indicate investor trust in tax-exempt securities, but both new issuer activity and performance metrics reposition municipalities as a strategic allocation in diversified portfolios. As key employment data looms, stakeholders will keenly watch how these developments might shape the next phase of market evolution.