The municipal bond market functions as a vital element in the overall financial landscape, reflecting economic stability and investor sentiment. The latest market activities, assessed in light of recent economic data and trends, reveal both resilience and underlying challenges. In this article, we will explore the current state of municipal bonds, yield trends, issuance patterns, and market sentiments, ultimately providing a comprehensive perspective on where the market stands as we approach the year’s end.

On a recent trading day, municipal bonds exhibited a steady performance with a tinge of weakness compared to prior sessions. As U.S. Treasury yields shifted, the effects reverberated through municipal yields, which experienced minor adjustments of up to two basis points. Specifically, this fluctuation affected the two-year, five-year, ten-year, and thirty-year yields, aligning fairly closely with benchmarks set by Municipal Market Data and ICE Data Services. The consistent patterns in the yield ratios suggest a market characterized by cautious optimism, albeit tempered by inflationary pressures that have remained persistent in recent months.

The consumer price index data, released the previous week, aligned with market predictions but raised alarms about sustained inflation risks. These factors inevitably push yields upward, albeit with the municipal market displaying only a muted response compared to U.S. Treasuries. As noted by Jason Wong from AmeriVet Securities, there appears to be a synchronization between municipal and Treasury yields but at a moderated pace, indicating investor vigilance amid uncertainty.

An analysis of recent municipal market performance reveals a troubling dip in total returns, which encountered losses of -0.54% month-to-date. Year-to-date returns have also fallen to 1.99%. This downturn stands in stark contrast to historically higher performance rates at this point in the year, highlighting the difficulties faced by municipalities in an environment of rising rates and narrowing spreads.

Daryl Clements from AllianceBernstein suggests that while December may usher in volatility, a potential Federal Reserve rate cut in the next meeting may help stabilize the market. The technical underpinnings that have supported municipal bonds of late suggest a more favorable outlook as we move into early 2024. Yet, the jarring reality of recent outflows from municipal mutual funds signifies a sector grappling with investor sentiment driven by macroeconomic indicators and liquidity needs.

A noteworthy observation in recent weeks has been the decline in municipal issuance volumes as we approach the year-end. Current estimations for the next week suggest a reduced issuance totaling around $2.5 billion, with the lion’s share attributed to a significant $1.5 billion deal from the New York Transitional Finance Authority. Such a drastic reduction from earlier robust issuance weeks indicates a hesitancy among issuers to enter the market under prevailing conditions.

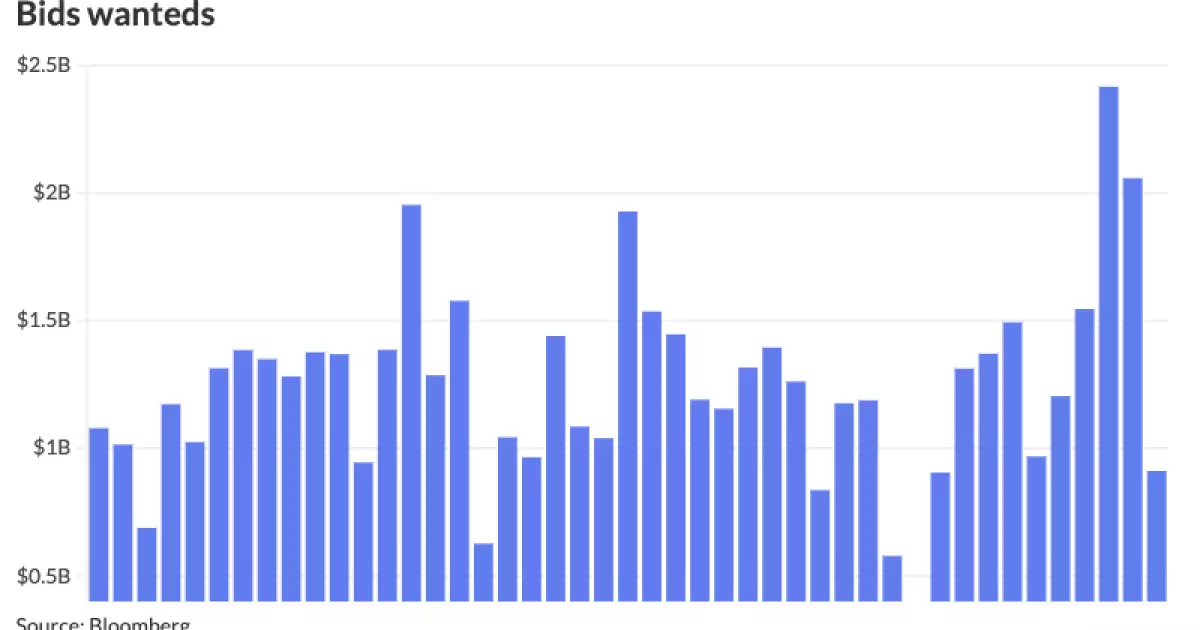

The dynamics surrounding bid lists and customer engagements reflect market participants’ attempts to adapt strategically to the diminished supply landscape. The surge in bid wanteds, reported at a staggering 62% over the trailing five-week average, illustrates how market participants are positioning themselves in anticipation of smoother liquidity as the year nears its end.

Investor behavior in the municipal market is notoriously fickle and tied closely to broader economic conditions. The recent outflows from muni mutual funds, amounting to $316.2 million during the week ending December 11, broke a streak of 23 consecutive weeks of inflows. This significant shift underlines the fragility of investor sentiment amidst economic fear, particularly with inflation concerns dictating decision-making processes. Conversely, the high-yield sector has reportedly seen inflows, which further emphasizes the divergence within fixed-income markets.

Despite favorable technical factors presenting themselves, such as net negative supply forecasts, the municipal market’s vulnerability to outflows remains a pressing issue. As noted by Birch Creek strategists, liquidity dynamics suggest a market ripe for choppy sessions ahead, particularly for those who find themselves classified as forced sellers. This phenomenon motions towards a critical juncture for investors where strategic assessment is paramount.

As we draw closer to the end of the year, the municipal bond market encapsulates a blend of resilience and hesitation. Amid mixed performance indicators, fluctuating yields, and changing investor sentiment, market participants are tasked with navigating a landscape laden with both challenges and opportunities. Understanding these nuances will be vital for investors as they seek to position their portfolios effectively in a continually evolving economic environment. As the financial sector braces for anticipated policy shifts and varying risk appetites, the future of municipal bonds remains an open question influenced by a multitude of factors.