The municipal bond market continues to showcase a fascinating interplay of supply, demand, and seasonal fluctuations. As we navigate through this complex financial landscape, it is essential to delve deeper into the recent trends shaping the municipal bond environment, including mutual fund movements, seasonality effects, and investor sentiment.

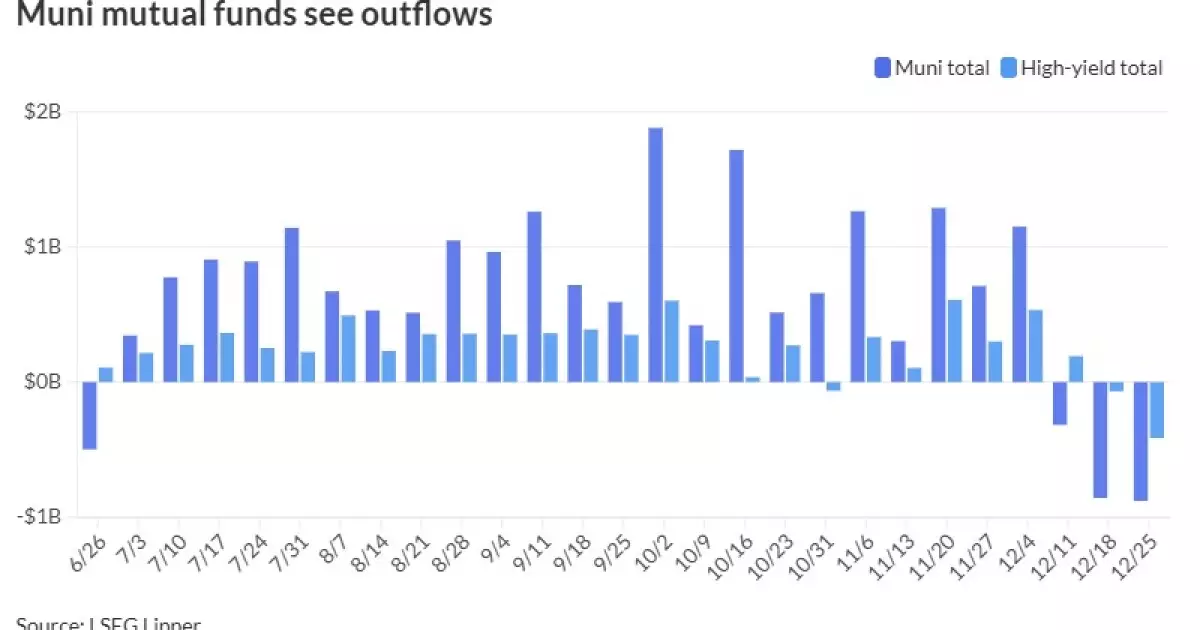

Despite facing a period of stagnation characterized by a lack of fluctuations, municipal bonds have shown resilience amidst various market pressures. The latest data reveals that municipal funds experienced considerable outflows, with investors withdrawing approximately $878.5 million for the week ending December 25. This response follows a notable pattern of outflows experienced in the preceding week, and raises questions about investor confidence.

The phenomenon of “seasonal winter softness,” as described by Jeff Timlin of Sage Advisory, highlights the technical vulnerabilities the market faces due to an overall reduction in trading activity. Factors contributing to this state include limited staffing in trading desks, which reduces liquidity, and a lack of new issuances to provide context for pricing. The market is also preparing for potential volatility due to year-end tax-loss selling, contributing to wider bid-ask spreads.

Investors opting to withdraw funds from municipal bond mutual funds represent a significant shift in sentiment, particularly over the holiday season. The previous week’s outflows, totaling $859.6 million, preceded the recent report indicating a continuation of this trend. In parallel, high-yield funds are experiencing similar patterns, with outflows of $413.6 million for the reported week, significantly up from $71 million the week before.

On the contrary, tax-exempt municipal money market funds experienced a reversal when examining inflows. Following a week of steep outflows, these funds saw an influx of $1.477 billion, bringing total assets in this sector to a respectable $133.17 billion. The dynamic of inflows in money market funds against the backdrop of mutual fund outflows creates a dichotomy in investor behavior, pointing towards a selective and cautious approach.

Looking ahead, the municipal bond market is poised for potential revitalization as the new year approaches. In a typical scenario, January marks a critical juncture for reinvestment activity, fueled by matured bonds and coupon payments. Timlin forecasts a “wall of money” that necessitates reinvestment due to seasonal cash renewals, setting the stage for heightened trading activity once the New Year begins.

While the current market dynamics display a bifurcated landscape with cash reserves sitting idle, the increasing interest in riskier assets like equities further complicates the environment. Nonetheless, the defensive nature of municipal bonds appears attractive, providing a stable alternative amid volatility in risk markets. Timlin notes that the significant cash reserve available could facilitate a recovery in valuations, which have tilled back toward fairer baselines in the latter part of the year.

Price actions among municipal bonds have shown minimal fluctuations, with the AAA bond yield curve largely unchanged across various maturities. The one-year yield was noted at 2.86%, while longer tenors reflected yields hovering near 3.08% to 3.92%. This stability contrasts with the renewed interest in taxable money funds, which saw inflows of over $53 billion after a period of outflows.

The continued attractiveness of the municipal segment is reflected in the yield ratios when compelling investors to weigh opportunities carefully. The two-year municipal bond to U.S. Treasury ratio remained at 65%, showcasing the competitive nature of municipal offerings in this tightening environment. Such a status speaks to the relative value proposition they represent against the backdrop of U.S. Treasury yields, which have also demonstrated remarkable stability.

As we move into the next fiscal period, the municipal bond market’s trajectory remains both unpredictable and ripe with opportunities. Understanding the critical balance between investor sentiment, market dynamics, and broader economic indicators will allow investors to position themselves more wisely. While we anticipate changes as new issuances emerge and cash flows into the market re-establish momentum, the resilience of municipal bonds as a defensive asset class will likely continue to be a focal point for many investors in the coming year. The interplay of caution and opportunity will define how stakeholders approach this evolving landscape in the months ahead.