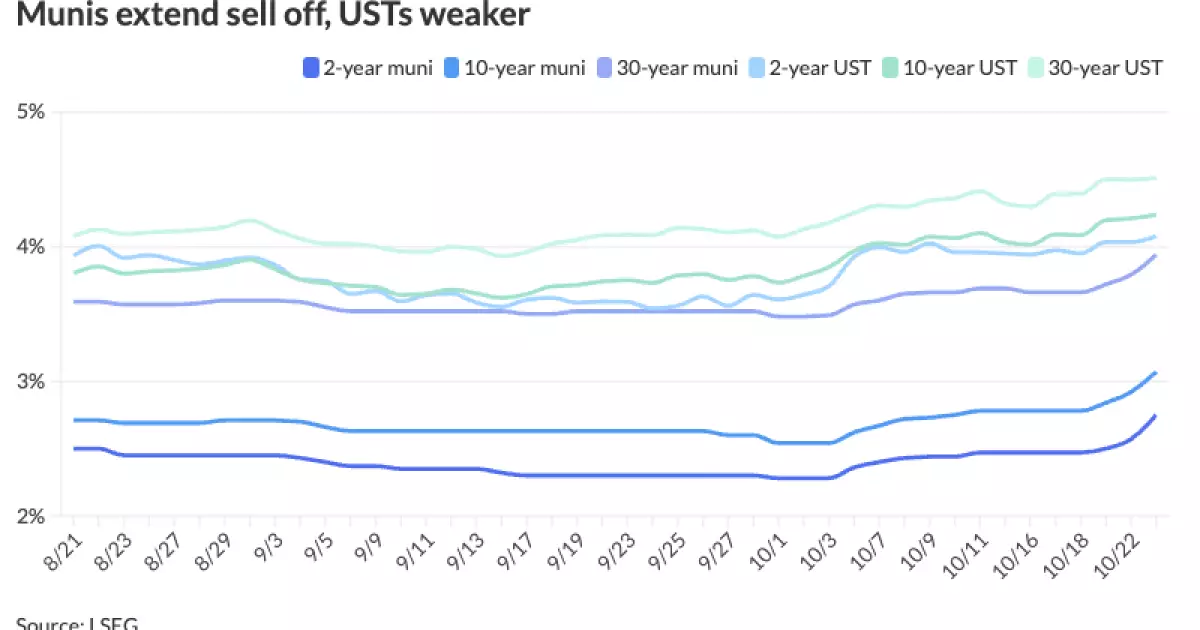

On Wednesday, the municipal bond market witnessed a significant correction as yields surged considerably, responding to the recent trends in U.S. Treasury rates. As a result of a series of previous outperformance, municipal bonds found themselves in a position where their yields were not in sync with their Treasury counterparts. The spike in yields was quite striking, with increases ranging from five to eighteen basis points, propelling the ten-year municipal yield above the crucial 3% mark for the first time since July. The escalation of U.S. Treasury yields ranged from one to five basis points on the same day, indicating a synchronized response from both asset classes albeit with varying degrees of impact.

The adjusted yield ramifications have profoundly affected the pricing of new deals in the primary market. As municipal yields adjusted upward, the ratios between municipal and Treasury yields also shifted. According to data from Refinitiv Municipal Market Data, the two-year ratio remained at 67%, while the ten-year ratio increased to 72%, and the thirty-year ratio rose to 87%. This uptick in ratios signals a market that is recalibrating in response to overall yield movements.

Kim Olsan of NewSquare Capital emphasized that the recent yield cut for municipal bonds was an overdue correction following a period of sustained outperformance that had pushed ratios to historically rich levels. This adjustment was necessary to get the market back into alignment with broader economic indicators and benchmarks.

Several macroeconomic factors contributed to this municipal yield resetting. The surge in U.S. Treasury rates is linked to the potential for a Republican election victory, which has intensified concerns about inflation and deficit spending. James Pruskowski, chief investment officer at 16Rock Asset Management, articulated that this political landscape has fostered an environment of uncertainty, thus softening secondary market liquidity within the municipal space. The accelerated issuance of municipal bonds reflects a rush among issuers to secure funding amidst this backdrop of policy unpredictability.

J.P. Morgan’s strategists also noted that the rise in tax-exempt rates aligns with the anticipated heavy supply of new bonds in the coming weeks, suggesting a market adjusting to a paradigm of heightened supply and reflected demand for better pricing. This dynamic has profound implications for investor sentiment and the overall performance outlook of municipal bonds as they navigate through this period of increased competition for capital.

Market Activity and Inflows

Despite the yield adjustments, the municipal bond market has shown resilience. Noteworthy inflows were reported in municipal bond mutual funds, with the Investment Company Institute indicating that there was a substantial inflow of $1.524 billion for the week ending October 16. This inflow followed a previous week’s inflow of $2.013 billion, marking a continuing trend of eleven consecutive weeks of positive inflows and providing a backdrop of investor confidence in municipal bonds despite the recent yield corrections.

Exchange-traded funds also saw notable activity, recovering from an outflow the previous week to register $1.205 billion of inflows. This resilience amidst changing yield dynamics underscores the sustained investor interest in municipal bonds as a viable asset class despite the fluctuations in yields.

Primary Market Developments and Future Outlook

In the primary market, a flurry of new deals was conducted amid the yield adjustments. For instance, the New York City Transitional Finance Authority managed to price $1.5 billion in future tax-secured subordinate bonds, with significant cuts applied from previous retail pricing. Other noteworthy transactions included various bond offerings from state agencies and educational institutions, indicating that the issuance landscape remains robust despite prevailing yield pressures.

The upcoming days will feature further issuance from a variety of municipalities and authorities, including a $1.125 billion Clean Energy Project financing in California and additional revenue bonds from various states. As these institutions actively engage with the market, the prevailing yield environment will dictate pricing strategies as issuers navigate their financing needs in a potentially volatile economic landscape.

The recent yield corrections within the municipal bond market underscore a complex interplay of macroeconomic dynamics, investor behaviors, and policy uncertainties. As yields adjust, the market must align itself with broader economic indicators while capitalizing on sustained investor interest. The outlook remains cautiously optimistic, contingent on how these forces interact in the coming weeks. Understanding these market trends will be crucial for investors looking to strategically position themselves amidst the evolving landscape of municipal finance.