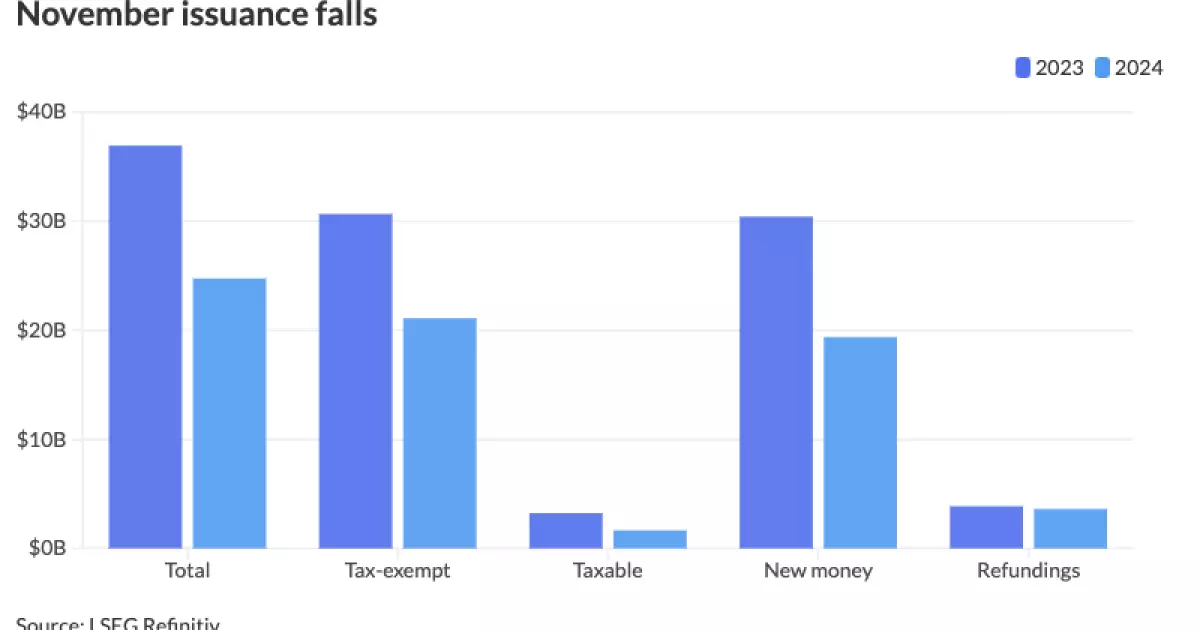

November’s bond issuance depicted a noteworthy decline, marking the first year-over-year drop in supply for 2024. The LSEG data shows that bond volume reached $24.743 billion through 607 issues, falling significantly by 33% compared to the previous year’s $36.918 billion from 822 issues. This downward trend is particularly concerning given that November’s total is not only below the 10-year average of $32.278 billion but also represents this year’s lowest monthly issuance. Despite this slump, issuance in 2024 is projected to set historical records, with year-to-date totals already at $474.755 billion—a striking 32.8% increase from 2023. This article aims to unpack the reasons behind this decline, the effects of current market conditions, and forecasts for future bond issuance.

One clear factor contributing to the reduced issuance in November is the first-week disruptions due to the Federal Open Market Committee meeting, alongside the preceding election. Tom Kozlik, head of public policy and municipal strategy at HilltopSecurities, indicated that limited pricing days directly affected the ability of issuers to enter the market. With key market interruptions, many potential issuances were sidelined. Chad Farrington, co-head of municipal bond investment strategy at DWS, echoed this sentiment, describing how the Thanksgiving holiday curtailed issuance activities even further.

Interestingly, while certain weeks saw heavier supply, such as the issuance of $1 billion in bonds for gas projects and $1.1 billion for airport improvements, these were insufficient to counterbalance the overall decline in November’s issuance figures. This underscores the impact of holiday cycles and the timing of significant market events that can disrupt normal issuance patterns.

Politics significantly influences bond markets, and in November, the elections created notable volatility. Despite a promising surge in the third quarter where six consecutive weeks recorded over $10 billion in issuances—likely an effort to capitalize before the elections—the anticipated volatility that followed was less severe than many had projected. The aftermath of the elections saw yields stabilize after an initial sell-off, suggesting that municipal bonds have stabilized, at least temporarily.

However, the change from election-induced uncertainty to ongoing policy uncertainty could persist into 2025, as Kozlik pointed out. This transition represents a shift in what investors must navigate and underscores the dynamic nature of market conditions in relation to political factors. The prospect of significant policy changes looming in the future could further exacerbate this uncertainty.

As we look forward to December, expectations hinge on potential issuance levels ranging from $20 billion to $30 billion. Nevertheless, a looming concern is the future of tax-exempt bonds, a topic generating significant debate among market strategists. Many anticipate that December could see a flurry of activity reminiscent of 2017 when the elimination of tax-exempt advanced refundings triggered a record $69.827 billion in month-end issuances.

Looking toward 2025, predictions are mixed. While many professionals expect issuance to float around the $500 billion mark, Kozlik stands apart with a more aggressive forecast of $745 billion. This divergence primarily stems from anticipated tax policy changes, which could fundamentally reshape the landscape for municipal bonds. The potential removal or restriction of the muni bond tax exemption could prompt issuers to flood the market to secure tax-exempt status before it becomes entirely unavailable post-2026.

Conversely, Matt Fabian from Municipal Market Analytics cautions that such legislative changes could significantly reduce issuance, projecting figures between $250 billion and $300 billion. This predictability hinges on the timing and nature of any tax changes and illustrates how political decisions can tangibly impact the bond market.

Zooming in on state-specific issuing patterns provides valuable context. California topped the charts with $68.902 billion issued year-to-date, reflecting a 31.1% increase year-over-year. Texas and New York followed closely, showing robust increases of 16.3% and 37.8%, respectively. Notably, Florida experienced an astonishing 103.8% year-over-year growth, indicating considerable investor interest.

While November’s bond issuance figures may raise alarms about declining market enthusiasm, the statistics indicate a landscape rife with complexities, particularly as political and economic factors continue to exert influence. The uncertainty surrounding future tax policies adds another layer, and stakeholders in the municipal bond market remain cautiously optimistic, preparing for fluctuations as the year progresses. The interplay of these elements will not only shape November’s depressed figures but also inform the trajectory of issuances in the months and years ahead.