The municipal bond market is experiencing a remarkable moment, characterized by a complex interplay of fluctuations in yields, supply-demand dynamics, and broader economic factors. As investors navigate through a maze of new issuances and changing interest rates, the state of the municipal bond market is of paramount importance, particularly for those focused on fixed-income assets. This article seeks to extract insights from recent trends and market conversations, providing a fresh perspective on the evolving landscape as we transition into the end of the year and the beginning of 2024.

Recent activity indicates a slight weakening in municipal bonds, as evidenced by a modest increase in yields and a mixed performance in equities. As the U.S. Treasury market grapples with its own set of challenges, munis have felt the effects, with yields rising by as much as two basis points. The correlation between municipal and U.S. Treasury yields remains strong, with ratios indicating that munis continue to offer attractive relative value. Specifically, observing the ratios over various maturities can provide insights into the risk-return profile that investors face.

Notably, the ratios for different durations demonstrate a relatively stable environment, suggesting that municipal bonds continue to be appealing despite a backdrop of rising Treasury yields. This scenario is crucial for assessing how institutional and retail investors position their portfolios under these conditions.

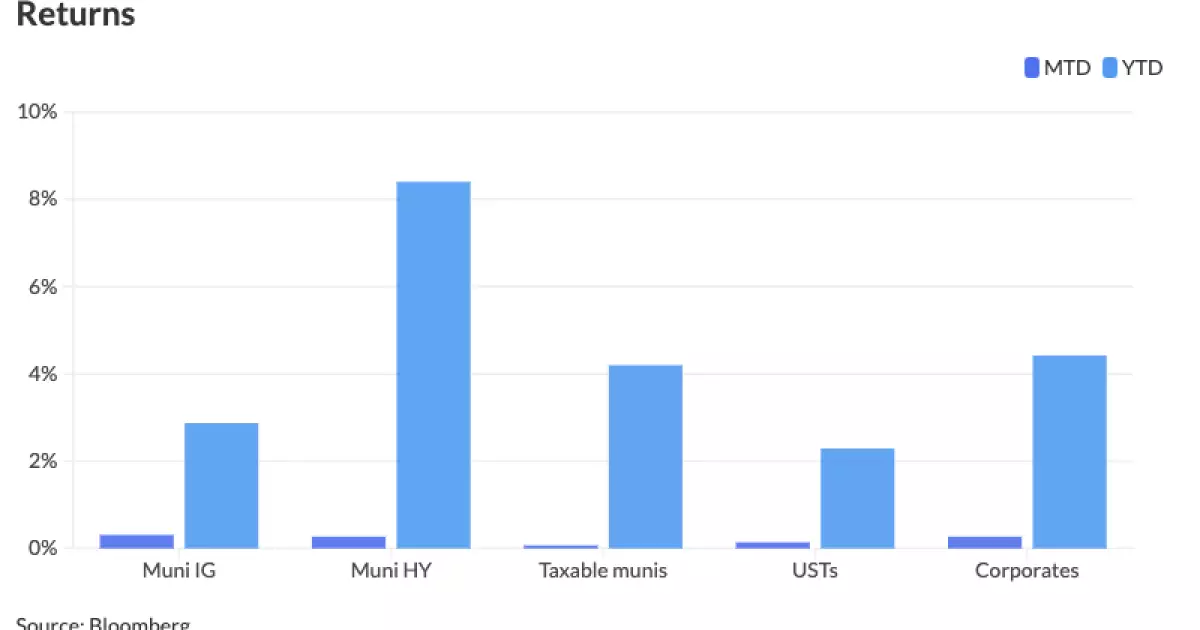

Experts in the field, such as Anders S. Persson and Daryl Clements, highlight the unexpected resilience of municipal bonds as we near year-end. While the issuance of nearly $500 billion in new municipal bonds this year could have saturated the market, the reality reflects a robust performance, with a year-to-date increase of 2.87%. This highlights an intriguing paradox: how can a sector absorb such significant new supply yet continue to exhibit strength?

The answer lies in the interplay of technical factors that drive the market. The anticipated influx of capital due to reinvestment strategies as the calendar turns over to January is expected to act as a tailwind for municipal bonds. Investors’ appetite for yield seems insatiable, particularly as high-yield munis outperform traditional ones. The suggestion that these trends will not only continue but potentially gain momentum into 2024 indicates an optimistic outlook for municipal asset classes.

As we delve deeper into the demand for municipal bonds, a compelling narrative emerges. The influx of $42 billion into mutual funds and exchange-traded funds speaks to a broader risk-on mentality among investors. This trend is especially pronounced in the high-yield segment, which has accounted for a significant 38% of total fund flows. The yeoman’s work of these high-yield muni funds, which have seen returns of 8.4% year-to-date, reflects a growing confidence in this subset of the municipal market.

The consensus among analysts suggests that the Federal Reserve’s impending rate cuts will likely create a favorable backdrop for munis. The market is pricing in significant expectations for rate reductions by December, followed by additional cuts in 2025. Given this environment, one cannot overlook the intricate dance between demand dynamics and monetary policy as key drivers of short-term performance.

In examining the primary market, transactions for municipal bonds are rolling out in a way that puts investor demand to the test. Recent offerings, including significant sales from high-profile states such as New York and Illinois, indicate a vibrant issuance landscape. Robust demand, underscored by competitive pricing and yield spread compression, suggests that institutional investors continue to engage actively despite the rising interest trend elsewhere.

The intricate details of these bond offerings — whether it’s the types of bonds flotation like revenue refunding bonds or general obligation bonds — shine a light on various investor strategies. The variations in callable and non-callable structures further enrich the conversation around investor preferences.

As we look forward to the last weeks of 2023 and the dawn of 2024, the outlook for the municipal bond market remains cautiously optimistic. The combination of favorable technical factors, the potential for rate cuts, and robust demand creates a fertile ground for growth. Despite the challenges of new issuances and fluctuating yields, the resiliency of the municipal market signifies a sector that, though tested, continues to thrive. Investors and analysts alike will be keen to observe how these trends evolve, making it an exciting time to engage in municipal bonds as we move into a new year with fresh opportunities and challenges on the horizon.