The realm of municipal bonds has recently illustrated an intricate backdrop of performance that warrants thorough examination. As municipal yields shift subtly in response to broader market dynamics, investors must navigate a landscape shaped by election outcomes, Federal Reserve policies, and seasonal variations, all of which play critical roles in shaping municipal market performance.

The municipal bond market experienced a narrow mix of performance as U.S. Treasuries demonstrated varied outcomes—initial losses up front and gains stretching into the long term. The yield adjustments—bumped or cut by as much as three basis points—underscore an environment still reeling from post-election volatility. According to strategists at BlackRock, investors should brace for continued fluctuations over the upcoming weeks as market participants work to comprehend the implications of election results and anticipated shifts in Federal Reserve policy.

What emerges from this evaluation is a broader certainty regarding the resilience of munis in the face of diminishing issuance rates. Seasonal dynamics typically favor municipal performance toward the year’s end, which may bolster investor confidence. Comparatively, this month mirrors conditions seen in November 2016, a timeframe marked by substantial trading activity as generic yields escalated by 50 to 70 basis points.

An integral aspect of the current municipal market is the observed disparity between municipal and U.S. Treasury (UST) yields. In particular, the municipal-to-UST ratios have been dexterously altered in response to a 30-basis-point correction in two-year UST yields. Recent readings indicate that the two-year municipal to UST ratio has landed at around 61%. In response, municipal flows may see adverse impacts owing to declining relative values, especially within the typically stable maturity range from 2026 to 2032.

Kim Olsan, a portfolio manager at NewSquare Capital, highlights that over 16% of secondary tax-exempt volume has trended in this specific corridor, hinting at a nuanced approach for yield-seeking investors. As the maturity curve exhibits a continued advantageous gradient, yields induce clearer concessions, with rates improving significantly as investors explore durations extending beyond a decade.

Expected increases in supply toward the close of 2024 could pose challenges for municipal bonds as investor sentiment remains tentative. Historically, November and December typically yield approximately $60 billion in total issuance, but varying levels of market volatility may diminish expected supply. For instance, the highs of 2019 saw the issuance peak at $83 billion, while 2022 presented a stark contrast with a mere $36 billion.

Significantly, as of the current election cycle, issuance had already approached or surpassed $440 billion, with aspirations for the total to breach the 2020 record of $484 billion. However, concerns over heightened rate volatility may prompt a retraction in issuance for the remainder of the year. Olsan speculates that lower levels of supply could bolster secondary yields, but overall direction will ultimately hinge on larger market elements, including bid evaluations and fund flows.

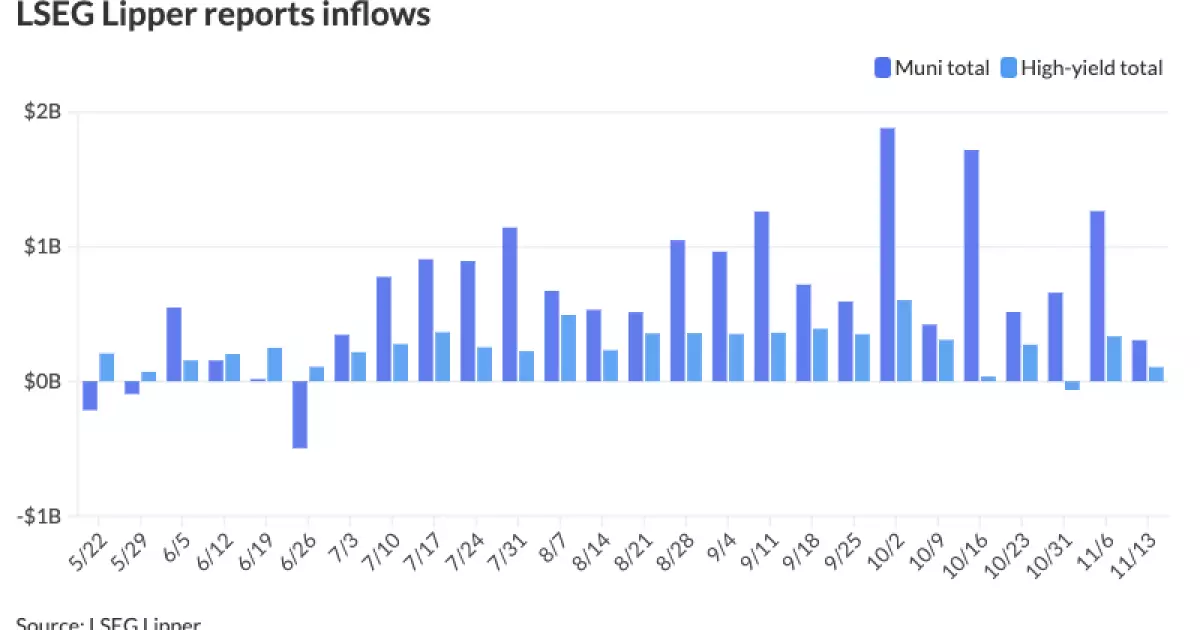

In the realm of fund flows, a noteworthy transition appears evident. The recent inflow of $305 million into municipal bond mutual funds marks the continuation of this growth trajectory, albeit well below the previous week’s influx of $1.264 billion. This development bears significance, qualifying as the twentieth consecutive week of inflow activity.

Notably, despite the inflows, high-yield funds exhibited a contrasting trend, capturing $105.3 million versus the previous week’s outflow of $333.3 million. This oscillation in investor appetite reveals potential risks ahead, particularly if market conditions shift and selling accelerates without robust backing from the fund complex. The nuances of daily bid list tallies, recorded at approximately $1.1 billion, suggest a traditionally stable figure but hint at forthcoming adjustments as portfolios recalibrate entering the year’s end.

Ultimately, the municipal bond market reflects a tapestry of intricacies derived from external influences and internal dynamics. Investors must remain acutely aware of shifting yields, changing ratios, expected supply variations, and evolving fund flow patterns to effectively navigate this multifaceted landscape. As market conditions evolve in anticipation of upcoming Federal Reserve sentiments and fiscal responses, strategic foresight and adaptability will be paramount for successfully engaging with the current municipal bond framework.