The municipal bond market witnessed a notable expansion in the third quarter of 2024, attributed to a surge in supply and increased ownership from mutual funds, exchange-traded funds (ETFs), and foreign investors. However, despite the apparent growth, challenges persist, particularly concerning the holdings of institutional investors, which seem to be on a declining trajectory. This article delves into the recent trends and insights regarding this vital sector of the financial landscape.

According to data released by the Federal Reserve, the total face value of municipal bonds outstanding has climbed to $4.171 trillion, marking a slight increase of 0.8% from the previous quarter and a more significant upturn of 2.9% from a year ago. This growth in outstanding bonds suggests that municipalities are increasingly tapping into the bond market to finance various infrastructural projects and public services, providing essential funding in an environment where fiscal pressures remain pronounced.

However, this rise in supply contrasts sharply with the substantial decline in municipal holdings by institutional investors, particularly banks. Recent analysis indicates that bank ownership of municipal bonds fell to $497.2 billion, reflecting a 0.3% decrease since the second quarter of 2024 and a more striking 4.3% drop compared to the same period last year. This trend raises concerns about the sustainability of municipal bond holdings in institutional portfolios, pivotal for maintaining liquidity and stability within the market.

The reasons behind the decline in municipal bond holdings among banks are multifaceted. Analysts at Wells Fargo highlight that reduced deposits, especially in smaller and medium-sized banks, coupled with regulatory challenges over recent years, have played a significant role in this trend. The shriveling deposit base has contributed to a contraction in the balance sheets of these banks, which further diminishes their capacity to invest in municipal assets.

Interestingly, the anticipated stabilization of larger banks’ deposit bases has yet to result in a corresponding increase in their balance sheets. This paradox is attributed to ongoing scrutiny regarding balance sheet sizes and regulatory constraints that continue to impact banks’ investment strategies.

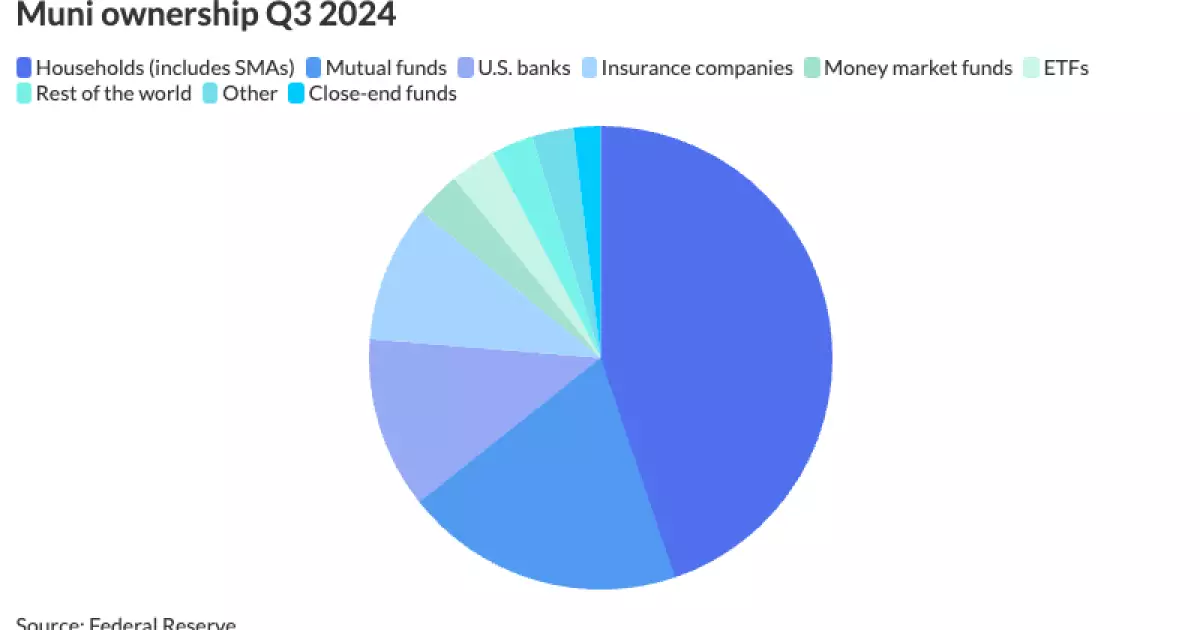

Despite the setbacks within traditional institutional investments, alternative ownership structures are gaining traction. Households now comprise the largest segment of municipal bond ownership, accounting for approximately 44.8% of total holdings. This shift underscores the growing trend of individual investors seeking stable income through municipal bonds, particularly through separately managed accounts (SMAs).

The significant increase in household ownership, which surged to $1.86 trillion, can be credited to the robust performance of SMAs. Similarly, mutual funds and ETFs also revealed growth, with mutual fund assets rising to $810.9 billion and ETFs skyrocketing to $133.3 billion in Q3 2024. This diversification in ownership is indicative of changing investor preferences, steering towards more flexible investment vehicles that can adapt to market conditions.

Interest in ETFs has surged, reflecting broader trends within investment behavior. Analysts have pointed out that municipal ETFs benefit from favorable trading costs compared to cash bonds, making them increasingly appealing to investors. As the market dynamics evolve, there’s a definitive shift from actively managed funds towards passive investment strategies, particularly in the absence of substantial credit stress in the municipal markets.

Furthermore, the improvement in returns from passive ETFs, which rivals those of actively managed funds, has made them an attractive alternative for cost-conscious investors. Although the market experienced dynamic growth in the previous years, experts believe that the current pace will moderate due to fewer tax-loss harvesting opportunities, alongside ongoing competition from equity markets.

The municipal bond market is in a state of flux, influenced by both external forces and internal dynamics. While the overall market size is growing, the decline in institutional holdings reflects broader challenges that need addressing. As new investors, particularly individuals, step in to take advantage of this financial tool, the sector must navigate the complexities brought about by changes in ownership structure and market behavior.

As municipal bonds become increasingly pivotal in financing public projects and providing steady returns for investors, stakeholders must remain vigilant to adapt to shifting trends and regulatory landscapes. The outlook, while optimistic in terms of growth, warrants careful monitoring to ensure that the challenges faced by institutional investors do not undermine the market’s overall health and sustainability in the long term.