The municipal bond market has recently demonstrated a fascinating equilibrium amid larger trading activities in the primary market. With substantial inflows into municipal bond mutual funds and volatility observed in U.S. Treasuries and equities, analysts and investors are keenly observing market dynamics that could redefine investment strategies and fiscal policies.

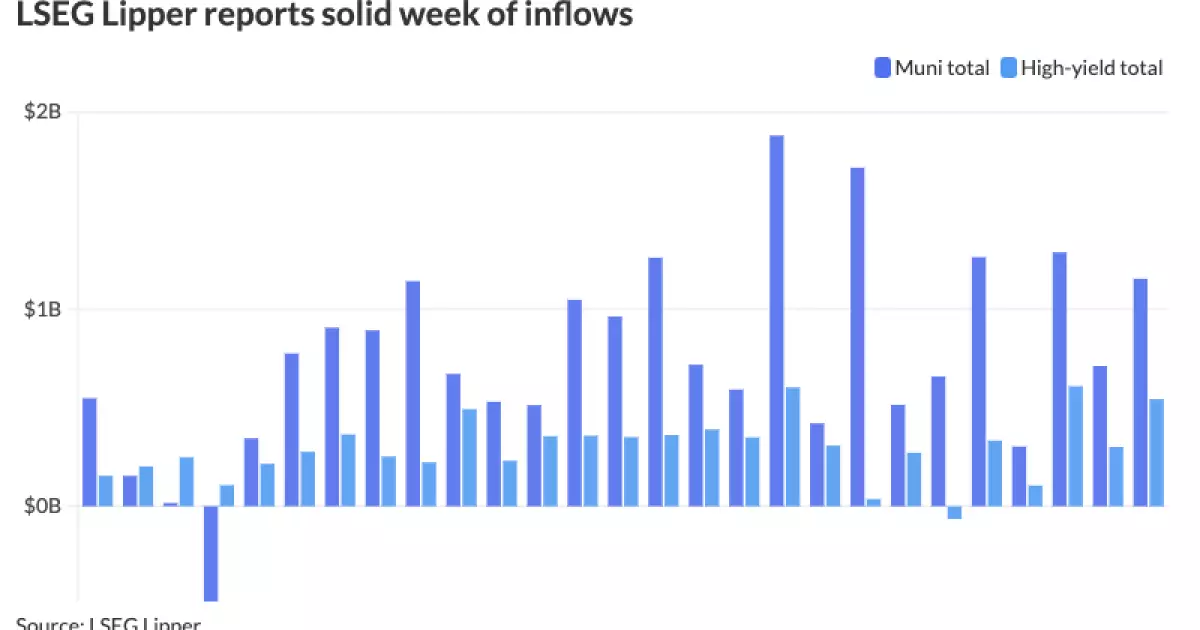

Recent reports indicate that municipal bond mutual funds have attracted inflows exceeding $1 billion, reaffirming sustained interest from investors. Lipper’s data shows a remarkable increase to $1.154 billion for the week ending December 4, a considerable jump from the previously revised figure of $711.5 million. Within this context, high-yield municipal bond funds alone attracted $534.1 million, suggesting that even in a fluctuating economic environment, investors remain enthusiastic about diversifying their portfolios with municipal securities.

Chris Brigati, a prominent figure in fixed income research, reported that the consistent inflow into these funds implies that investors are not fatigued by market opportunities and continue to engage actively. Such signaling begs the question of what factors are driving investor sentiment in a climate where other asset classes, like equities, appear less favorable.

Comparative Analysis of Municipal Ratios

The municipal bond market’s ratios are also critical in understanding current valuations and investor decisions. The two-year municipal to U.S. Treasury ratio stood at 61%, while the five-year was recorded at 63%. In the longer maturities, the ten-year registered at 65%, and the thirty-year climbed to 82%. These figures, as provided by Refinitiv Municipal Market Data, reflect an intricate relationship between municipal bonds and treasury securities that investors closely monitor for opportunities.

ICE Data Services reported similar ratios, with slight variances, indicating a consensus in market assessment. A lower ratio points to greater value in municipal securities compared to treasuries, which can spur a more aggressive investment stance among discerning investors looking for yield outside of the government bonds.

In the primary market, activity has surged, attributed in part to seasonal rebalancing. The influx of new issuances can be particularly instructive. Brigati noted the momentum from larger issuances following periods of reduced supply may reflect an attempt by issuers to capitalize on favorable market conditions before the new year, especially as December historically sees increased issuance volumes.

Matt Fabian, from Municipal Market Analytics, raised a crucial point regarding fear of potential modifications to tax exemptions for municipal bonds. This uncertainty can significantly influence issuance and overall market health. Indeed, if tax exemptions were curtailed, not only would infrastructure investment suffer, but the ramifications could ripple through to overall economic growth.

The discussion around preserving tax exemptions for municipal bonds cannot be overstated. Both major political parties acknowledge the necessity for improved infrastructure spending, which hinges on the ability to attract investment through tax-exempt bonds. Analysts Matthew Norton and Daryl Clements stress that any elimination of these exemptions would negatively impact local economies and financing for essential projects.

They argue that the prospective savings for the federal budget are minimal compared to the broader fiscal health and infrastructure demands across the nation. The preservation of tax exemptions is not merely an issue of cost but one of strategic economic positioning for local governments in their quest for capital.

Recent primary market transactions exhibit the variety and scale of municipal bond issuances. For example, Barclays has priced $1.5 billion in transportation program bonds for the New Jersey Transportation Trust Fund Authority, suggesting strong institutional interest. Similarly, substantial issuances by the Greater Orlando Aviation Authority reflect ongoing infrastructure needs as they navigate a post-pandemic recovery.

Further, RBC Capital Markets’ pricing of $653.63 million in sales tax securitization refunding bonds illustrates the diverse funding mechanisms municipalities are utilizing to manage fiscal pressures. Each issuance speaks to a broader narrative of adaptation and resilience within the municipal sector.

The current state of municipal bonds underscores a complex interplay between investor sentiment, market ratios, political considerations, and primary market activities. As 2023 draws to a close, stakeholders must navigate this intricate landscape with a clear vision and strategic foresight to maximize opportunities and mitigate potential challenges ahead. Investors, issuers, and policymakers alike will play pivotal roles in shaping the trajectory of municipal financing in the coming year.