Warren Buffett continues to reshape his investment strategy by significantly reducing Berkshire Hathaway’s stake in Apple. This development marks the fourth consecutive quarter in which the company has sold a portion of its holdings, a substantial shift for what was once its largest equity position. As of late September, Berkshire reported owning Apple shares worth approximately $69.9 billion, revealing a notable decrease—around 67.2%—from the same period the prior year. The divestiture has seen Buffett parting with nearly 300 million shares, leaving him with a little over 300 million left in his portfolio.

Motivations Behind the Selling

Though the precise drivers behind Buffett’s increasingly aggressive divestment remain ambiguous, they likely stem from a combination of factors. Analysts have speculated that high stock valuations and the need for better portfolio diversification prompted this decision. At one point, Apple accounted for an astonishing half of Berkshire’s entire equity portfolio, which surely raised concerns about overexposure to a single asset. By reducing this stake, Buffett can mitigate risk and rebalance his portfolio, although it is evident that the scale of the sales suggests a more complex motivation may be at play.

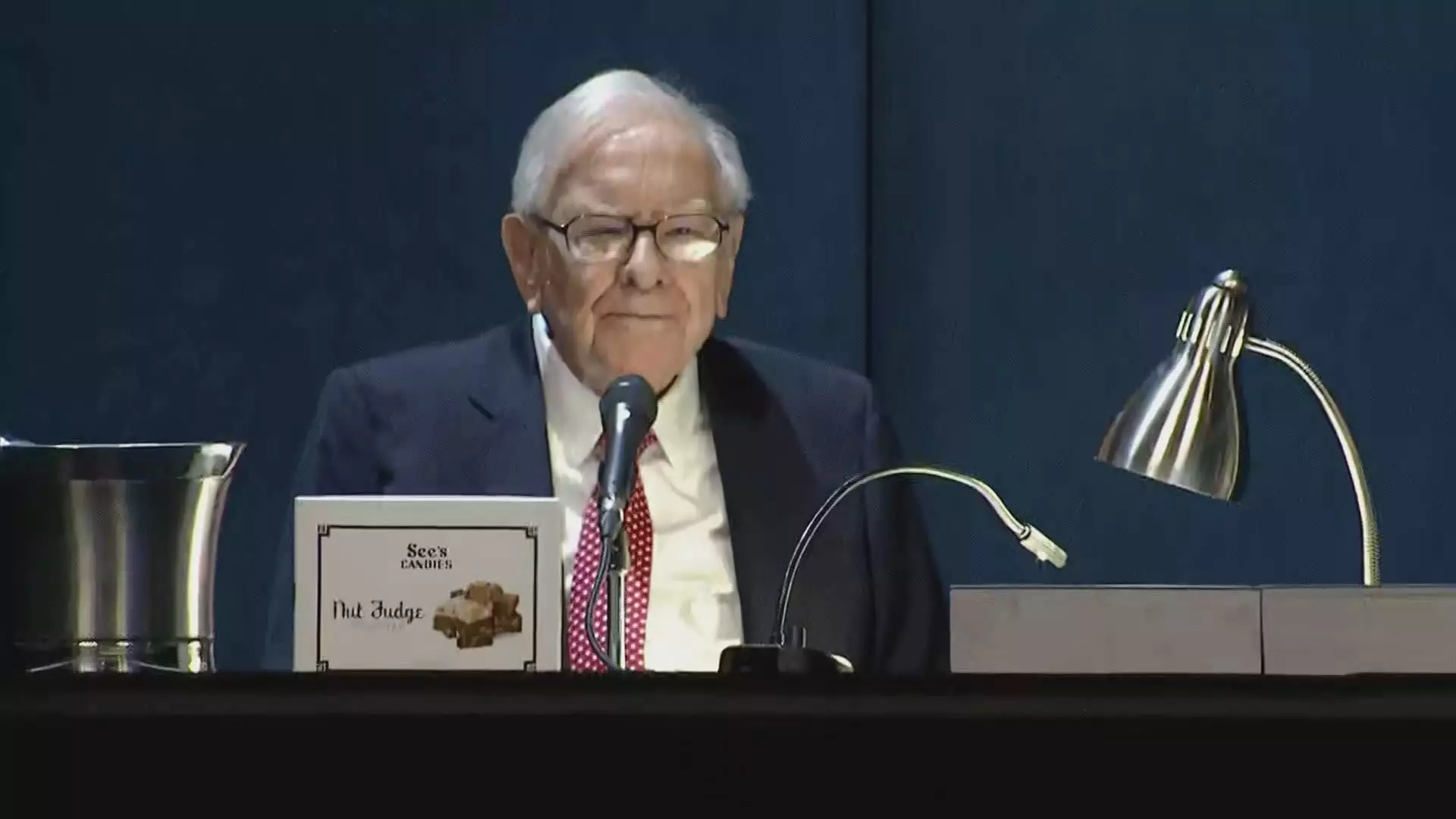

During the annual Berkshire meeting in May, Buffett hinted at potential tax implications as a driver for this selling spree. With looming government discussions about increasing capital gains taxes to address a growing fiscal deficit, he appears keen on positioning Berkshire favorably for future regulations. Despite these rationales, the magnitude of the sales raises questions: is this merely a tax strategy, or are there deeper concerns regarding Apple’s long-term performance?

Buffett’s relationship with Apple has dramatically evolved since Berkshire first invested in the tech giant over eight years ago. Historically, Buffett has shied away from technology investments, often arguing that they lie outside his “circle of competence.” However, upon observing Apple’s strong customer loyalty and the widespread adoption of iPhones, he reconsidered, declaring it the second-most significant company in Berkshire’s portfolio, just behind his insurance enterprises.

The initial enthusiasm surrounding Apple’s business model was well-founded; the company’s robust ecosystem captivated both Buffett and investors alike. Yet, the current selling trajectory may suggest an awakening to the realities of the tech market’s volatility, forcing Buffett to reconsider the sustainability of such a hefty investment in a single company.

Adding to the intrigue, Berkshire’s cash reserves have reached an unprecedented $325.2 billion as of the third quarter, highlighting Buffett’s cash-centric strategy amidst the selling frenzy. Notably, the firm paused buybacks entirely during this quarter, a move that reflects a cautious approach when navigating potential future investments or opportunities.

As Apple shares have climbed 16% year-to-date, compared to the S&P 500’s 20% rise, implications for its future performance remain debated among analysts. Buffett’s recent actions raise crucial questions about not only Apple’s trajectory but also the rigor and adaptability of Berkshire Hathaway’s strategies in a rapidly changing economic environment. Ultimately, Buffett’s selling of Apple suggests a pivot in thinking, evoking the necessity to balance growth with prudent risk management in investment principles.